Originally Posted at DW Slater Company Appraisal Blog

Are you considering buying a house near railroad tracks? or Are you already living near railroad tracks? How does this affect the value of your home?

The Dictionary of Real Estate Appraisal defines “external obsolescence” as an element of depreciation; a defect, usually incurable, cased by negative influences outside a site and generally incurable on the part of the owner, landlord or tenant.

Railroad tracks would be considered an outside influence that is not curable by the owner, landlord or tenant. Most buyers would be willing to pay more for a house not located near the sound of the train horn roaring by at all hours day and night. So how does an appraiser determine the effect of the external influence of a rail road track when a property is located nearby?

The amount of depreciation of the external obsolescence of a rail road can be determined by looking at the market doing a pair sales analysis. An appraiser can look at similar sales of homes located near the railroad tracks and similar homes that are not located near the railroad tracks and the difference in sale price would determine the adjustment amount. For another example of how adjustments are determined you can read my post on how adjustments for pools are determined.

Sometimes the influence is very minimal, especially in the case of small markets with very few sales. The small community of Pilot Point has recently been considering a noise ordinance to prohibit the train horn sounding through the community. Some wanted to know the effect of the values for homes near the train. We did a market analysis to determine the effect of the train and we did not find a great reduction in values of homes located near the train. Pilot Point is a very small community with a population of 4,006 per 2013 census data. The town is one of the oldest in Denton County and grew up around the rail road and the track runs right through the middle of town.

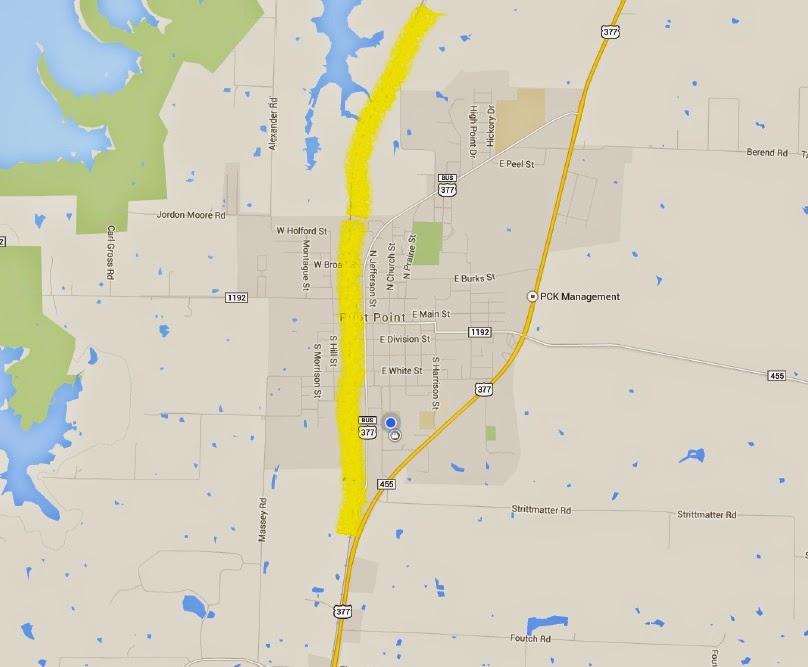

Here is a map of the city of Pilot Point and we have highlighted the train tracks in yellow.

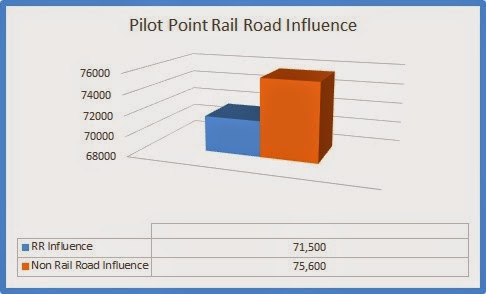

We looked at sales of homes within a block both directions of the rail road tracks. The majority of homes along the railroad track were built prior to 1980 and are less than 2,000 sq ft. Appraisers must compare apples to apples so decided to compare all homes built prior to 1980 with 2,000 sq ft or less located a block from the railroad tracks to homes built prior to 1980 with 2,000 sq ft or less located in the rest of Pilot Point (excluding the sales a block from the tracks). There were so very few sales that we increased the time to all sales within the past five years. Here are our findings.

When you look at the five history the median sale price of sales of our comparison homes near the railroad was $71,500 and the median sale price of homes without the railroad influence was $75,600. So there is a difference of $4,100. You could conclude an adjustment of around $4,000 for the external influence of the railroad. It is noted that this is a very small pool of data (24 sales).

There are differences in every market. Here is a map of the city of Aubrey which is located five miles south of the city of Pilot Point. Similar markets but different. Here is a map of the city of Aubrey with the railroad highlighted.

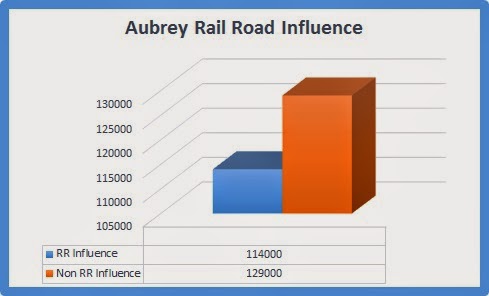

Aubrey had more sales than Pilot Point and the majority of the homes built along the railroad were built after 1990 and were less than 2,000 sq ft. Looking at sales built after 1990 with less than 2,000 sq ft located a block from the railroad and those that were not we did the same comparison. We also looked at sales for the past five years. Here are our findings:

In this comparison, the median sale price of homes near the railroad is $114,000 and the median sale price of homes without the railroad influence is $129,000. There is a difference of $15,000. You can conclude that the railroad influence in Aubrey is much greater than the influence in the city of Pilot Point as this data pool is 60 sales.

You can conclude that the railroad influence in Aubrey is much greater than the influence in the city of Pilot Point. Since there are fewer sales in Pilot Point the market will not reflect as much difference in railroad influence as there is less competition. This analysis illustrates why markets must be analyzed individually to determine the market adjustment.

We hope this helps in understanding the influence of railroads on real estate. This is certainly not the only way to determine the external influence on properties but with limited data in small markets we believe this gives us a good indicator of railroad influences in two separate markets.